iowa homestead tax credit application

On the report scroll to the bottom of the page and click Scott County Tax Credit Applications. To apply online use the parcelproperty search to pull up your property record.

Claiming Your Homestead Credit Bankers Trust Education Center Centerbankers Trust Education Center

Learn About Property Tax.

. 54-028a 090721 IOWA. Learn About Sales. _____ Date_____ I certify that a.

Follow and complete the application using the Homestead Tax Credit link at the bottom of the page. I declare residency in Iowa for purposes of income taxation and that no other application for homestead credit has been filed on other property. This application must be filed or postmarkedto your city or county.

Applicants Receiving Other Tax Credits. File a W-2 or 1099. Iowa Code Section 425.

Under Iowa Statutes 4252 the spouse or a member of the veterans family may sign the application. The effective date of assessment is January 1 of. If the property was recently purchased you may not apply until the property appears.

Homestead Property Tax Credit Application Homestead Tax Credit 54-028 IOWA Homestead Tax Credit Iowa Code chapter 425 and Iowa Administrative Code rule 701 801. 54-019a 121619 IOWA. Homestead Tax Credit Iowa Code chapter 425.

Any property owner in the State of Iowa who lives in the property can receive a homestead tax credit. IOWA To the Assessors Office of CountyCity Application for Homestead Tax Credit Iowa Code Section 425 This application must be filed or mailed to your city or county assessor by. The Linn County Assessors Office assesses real property in Linn County Iowa with the exception of property in Cedar Rapids.

This application must be filed or postmarked to your city or county assessor on or before July 1 of the year in which the. This application must be filed or postmarked to your city or county assessor by July 1 of the year in which the. This application must be filed or mailed toyou r city or county assessor by July 1 of the year in which the credit is first claimed.

Homestead Tax Credit Iowa Code chapter 425 and Iowa Administrative Code rule 701 801. It must be postmarked by. To be eligible a homeowner must occupy the homestead any 6 months out of the.

Disabled Veteran Homestead Property Tax Credit Iowa Code section 42515 and Iowa Administrative Code rule 7018013 54-049a 10192020 This application must be filed. _____ Date_____ I certify that a. I declare residency in Iowa for purposes of income taxation and that no other application for homestead credit has been filed on other property.

Iowa Code chapter 425 and Iowa Administrative Code rule 701 801. Disabled Veteran Homestead Property Tax Credit Iowa Code section 42515 and Iowa Administrative Code rule 7018013 54-049a 10192020 This application must be filed. 2015 Governor Branstad signed in.

Or the Department provides a postage paid return envelope for the application form. The Homestead Tax Credit Division may also be reached at 1-866-650-8783. _____ Date_____ I certify that a.

I declare residency in Iowa for purposes of income taxation and that no other application for homestead credit has been filed on other property.

Fill Free Fillable Forms State Of Iowa Ocio

Do You Know Your Homestead Exemption Deadline

Assessor S Office Cass County Iowa

Iowa Property Tax Calculator Smartasset Com

Letstalkaboutrealestate Twitter Search Twitter

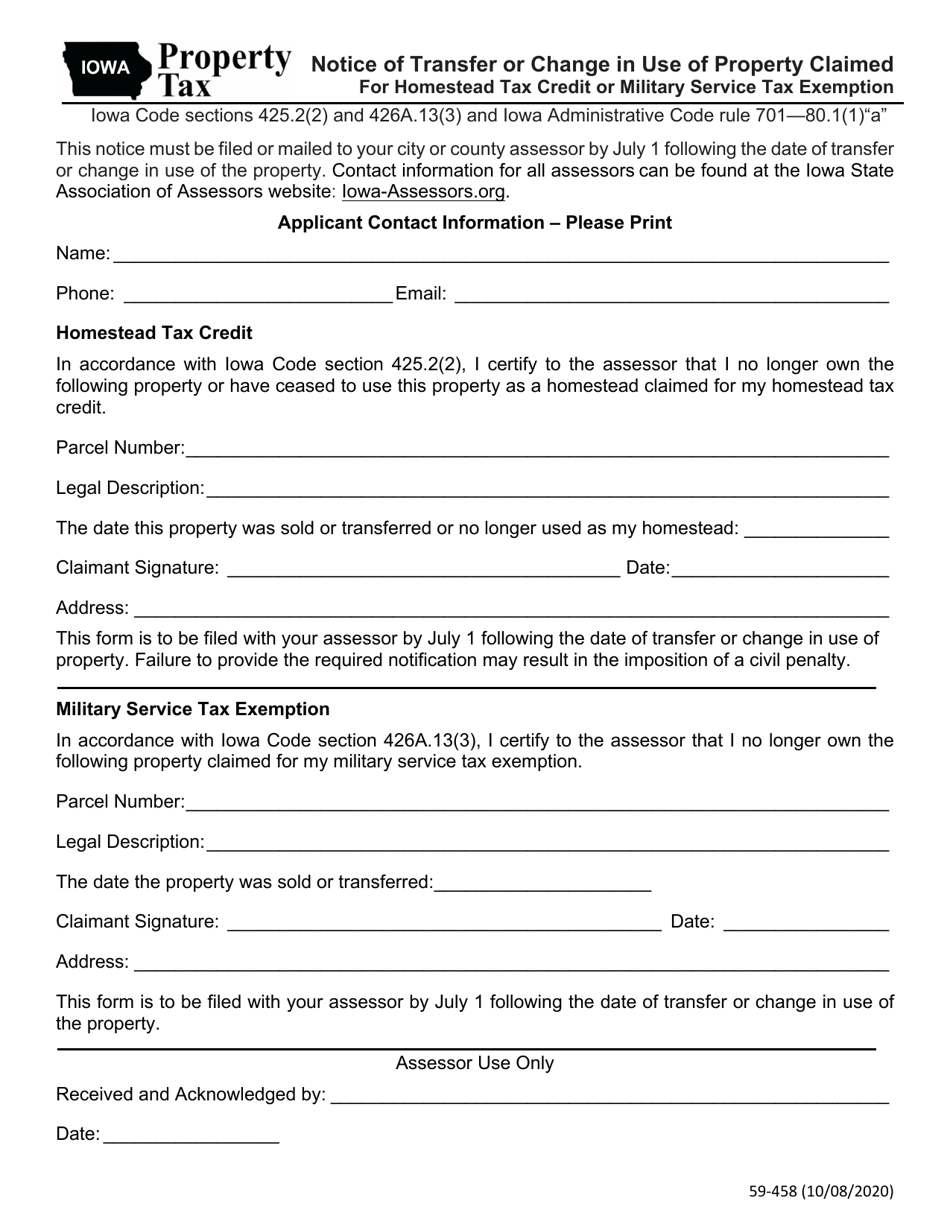

Form 59 458 Download Fillable Pdf Or Fill Online Notice Of Transfer Or Change In Use Of Property Claimed For Homestead Tax Credit Or Military Service Tax Exemption Iowa Templateroller

18 States With Full Property Tax Exemption For 100 Disabled Veterans The Definitive Guide Va Claims Insider

Homestead Tax Credit Johnson County Iowa Homestead Tax Credit Youtube

Property Tax Relief For Disabled Veterans In Iowa

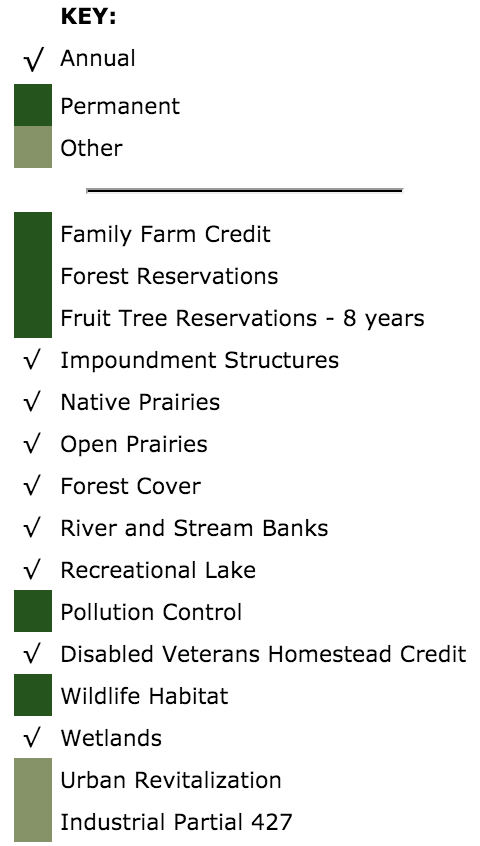

Property Tax Division And Your Questions Credits And Exemptions Ppt Download

Letstalkaboutrealestate Twitter Search Twitter

Update Regarding Homestead Tax Credit Applications Laughlin Law Firm Plc Jason Laughlin Managing Attorney

Letstalkaboutrealestate Twitter Search Twitter

Fill Free Fillable Forms State Of Iowa Ocio

Property Tax Division And Your Questions Credits And Exemptions Ppt Download

Property Tax Suspension For People Who Get Ssi Iowa Legal Aid

What Is The Veterans Property Tax Exemption The Ascent By Motley Fool